Biogazelle

We changed our business model several times during our journey, but now we have really become a company that makes long-term investments with high risk, but also with high leverage.

Jan Hellemans, founder Biogazelle

Cancer research has gained momentum in recent years. The progress is mainly driven by a better understanding of the mechanisms that cause cancer, making medical solutions increasingly sophisticated and effective. Thus, the fight against cancer is no longer a search for the holy grail. Biogazelle, a Zwijnaarde-based company, is contributing to that hope for a better cure.

Biogazelle uses RNA analysis as a diagnostic and therapeutic model. Ribonucleic acid, often abbreviated as RNA, is, next to DNA and proteins, one of the three macromolecules essential for all known life forms. Reading RNA gives a view of what goes wrong within a particular cell, and how that leads to cancer. Knowing where and how things go wrong: that is important to determine whether or not a particular therapy can work, and to refine it. Biogazelle founder Jan Hellemans explains: “In the past, a lung cancer was just lung cancer. Now the lung cancer that person A has is a different lung cancer from that of person B. Thanks to more sophisticated analysis, we can better tailor the therapy to what is going wrong, and we can also limit side effects much more.”

Fast grower

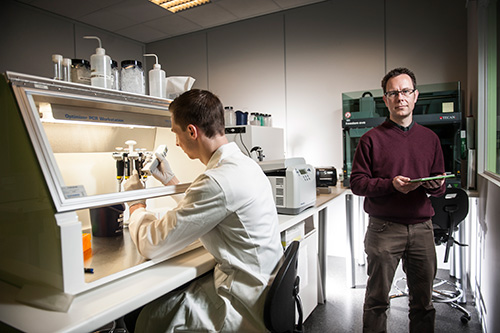

In 2014, Biogazelle fell just outside the top-10 of Deloitte Technology Fast50, a ranking of the fastest-growing companies. It is an illustration of the strong track record they have built since 2007. Jan Hellemans: “Together with my partner Jo Vandesompele, we started very minimalistically as a spin-off from the University of Ghent. We grew organically and always invested our profits in the company. As a result, we were able to present growth figures of 70% for several years in a row. We now also employ 25 people”.

In the beginning, the focus was on selling software for data analysis; later, they also started performing RNA measurements in the lab as a service to companies and academic institutions that want to outsource part of their research. Still later, they also added product development in subcontracting for other companies. At a certain point, they realised that they had a lot of assets to put into therapeutics and diagnostics themselves. After all, all the expertise and know-how was in-house to leverage their own clinical development. The only thing missing were the resources to fund such a research programme. For that purpose, they looked for external funding.

Potential

Jan Hellemans: “We adjusted our business model several times during our journey, but now we have really become a company that makes long-term investments with high risks, but also with high leverage. That is also inherent to entrepreneurship, I think: seeing the potential lying ahead and wanting to go for that potential. Biotech is a risk story, but we and our investors are very confident.”

Along with the business model, the funding model has also thoroughly evolved and the amounts are of a totally different order than in the early stages. Recently, the last tranche of the Winwin loan was repaid. According to Jan Hellemans and the borrowers, this was the best investment ever and effectively a win-win for both parties, also considering the interest rate evolution of the last few years. In addition, he also praises the other initiatives to support Flemish biotech: “When I look around at our neighbouring countries, I think we certainly cannot complain in Flanders. Support from IWT (now Agentschap Innoveren en Ondernemen), for example, is something the Dutch can only dream of. Even this location in Zwijnaarde is quite important as a biotech cluster.”